- Deposit $500 or more—direct deposit not required.

- Log in to online banking or the 4FrontGo app once—that's right, just once.

- Make 15 or more purchases with your 4Front Debit Mastercard®—easy peasy.

- Be enrolled in eStatements/eNotifications—set it and forget it.

Straight4ward Rewards Checking Account

Yep! You read that right.

With a Straight4ward Rewards checking account, you get 4.08% APY* on your checking account balance. In simple terms, that's up to $50 a month or $600 a year! All with no fees and no jumping through hoops. You only need to meet four simple monthly requirements:

But wait! There's more to love.

- No fees—No need to worry about those pesky fees or minimums, keep that money in your pocket (or account).

- Get paid sooner—access your money up to 2 days sooner.**

- Forget the overdraft fees—opt-in to Overdraft Protection and know you've always got a safety net.

- Bank your way—you've got plenty of options. Come visit us in person or do your banking completely online!

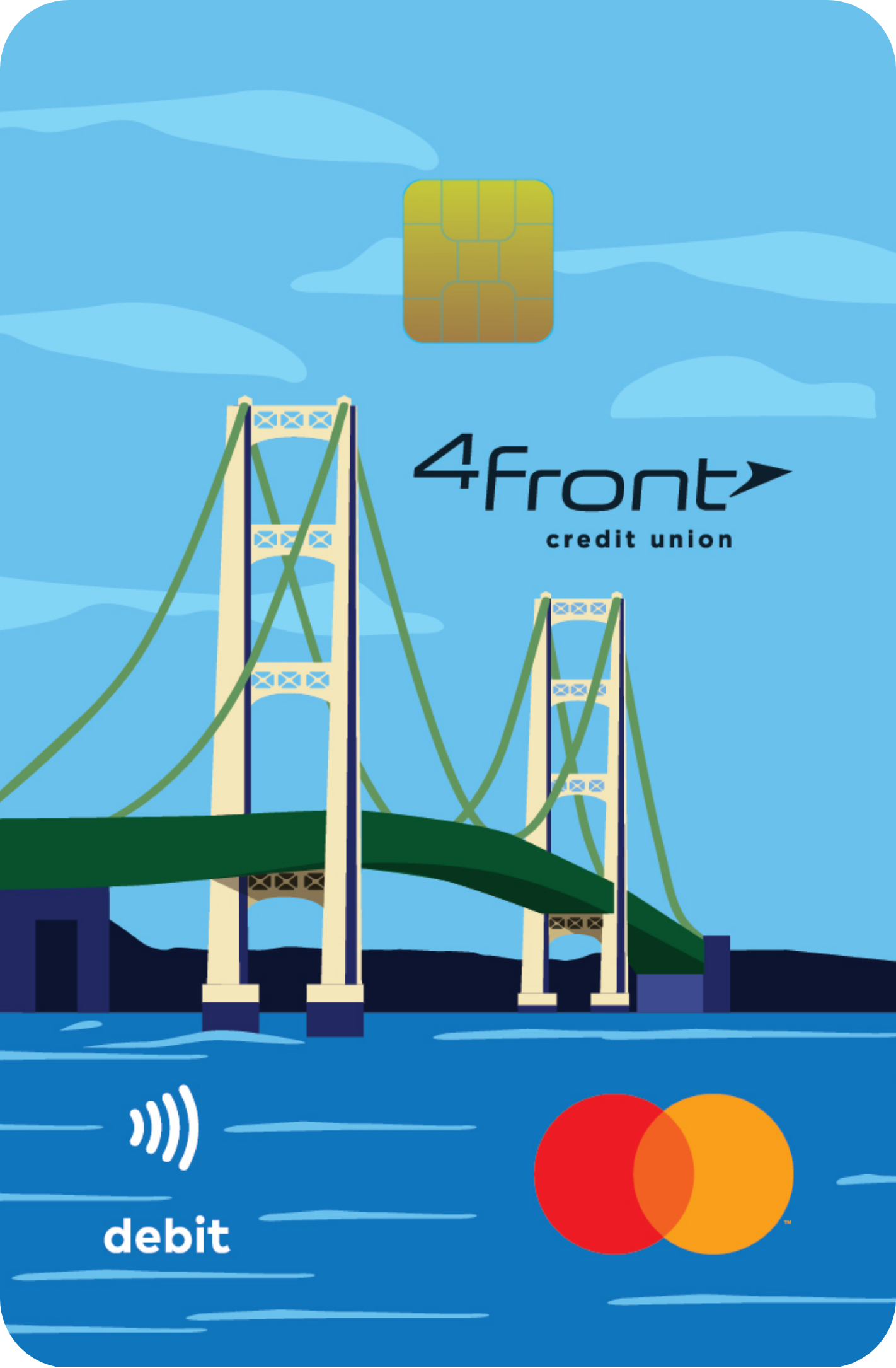

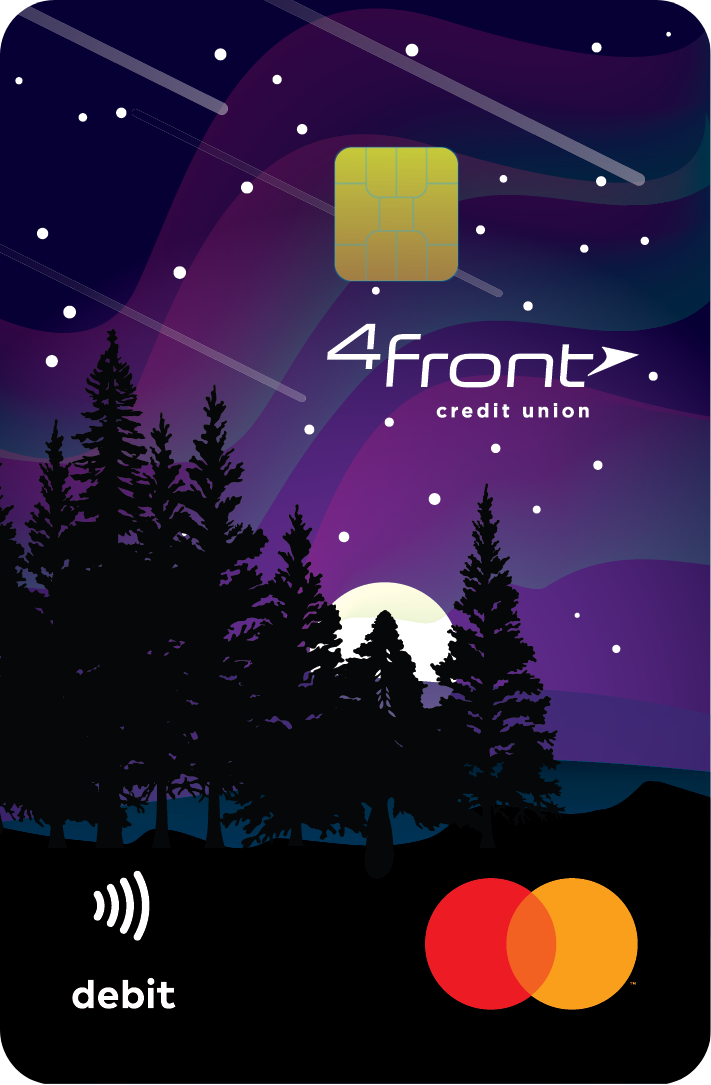

Swipe in fashion!

Our debit card designs celebrate the beauty of our state—with scenic inspiration drawn from its landscapes and one classic 4Front design that feels right at home in your wallet.

Ready to join? Let's get started!

Wherever you are on your financial journey, we'll make your banking smart and simple.

*4.08% annual percentage yield (APY) paid monthly on a balance of $0.01 to $15,000. Rate effective 10/17/2022. Rate subject to change. Membership required with $1 deposit to open a Prime Share. Some requirements apply. APY = annual percentage yield, or the effective rate of return taking into account the effect of compounding interest. Fees may reduce earnings.

**Preauthorized ACH credits received by 4Front Credit Union may be credited to accounts as soon as two business days prior to the scheduled posting date. If the ACH originator does not submit the information ahead of time, 4Front will be unable to deposit funds early. In this case your deposit will be posted on the scheduled posting day. 4Front is not responsible for fees or penalties resulting from transactions in advance of an early ACH credit posting.