A credit score is a three-digit number calculated with information from your credit report to determine your credit worthiness. The higher the score, the more credit worthy you are to a lender. This number is taken into consideration when applying for loans, buying cars, even signing up for a new cell phone service. So how do you know what your score is? SavvyMoney!

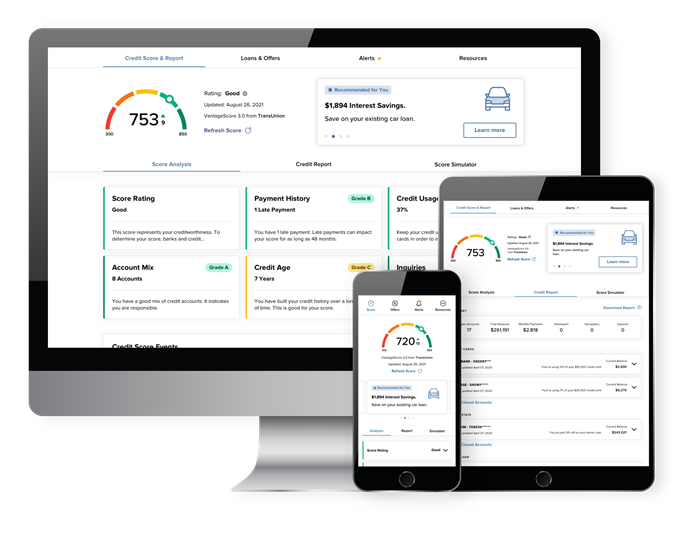

Credit Score Powered by SavvyMoney is available to all 4Front Credit Union members through online banking or in the 4Front Go mobile app. It is a free service offered to help you understand your current credit score, give access to your credit report, provide credit monitoring alerts, and see ways you can save money on new and existing loans with us.

What’s not to love?

Credit Score also monitors your credit report daily and informs you through digital banking and by email if there are any big changes detected such as: a new account being opened, changes in address or employment, if a delinquency has been reported, or an inquiry has been made. Monitoring helps users keep an eye out for identity theft which is key for financial safety!

Use the SavvyMoney Credit Report to view all the information you would find on your credit file including a list of current or previous loans, accounts, and credit inquiries. You will also be able to see details on your payment history, credit utilization, and public records that show up on your account. Use these to improve your score!

It’s important to note that SavvyMoney pulls your credit profile from TransUnion and uses VantageScore 3.0, a credit scoring model developed collaboratively by the three major credit bureaus: Equifax, Experian, and TransUnion. This model seeks to make score information more uniform between the three bureaus to provide consumers a better picture of their credit health. The pull is always a “soft inquiry”, which does not affect your credit score.

Another great feature, The Score Simulator is an interactive tool that allows you to select various actions you may take and see how your score could be affected. Different actions, like paying off a credit card balance might make your score move up or down. A great tool if you’re hoping to improve your score before applying for lending!

4Front is thrilled to be able to offer SavvyMoney to our members because we know how important understanding your credit is and we love helping you succeed in whatever you do.